How to Create a Successful and Profitable Wedding Photography Business From Scratch

Building a successful wedding photography business doesn’t happen overnight. It takes hard work, dedication, and a lot of learning. But if you’re passionate about weddings and love taking photos, it can be a very rewarding career.

From keeping up with technology and trends in the industry to managing customer expectations, there are plenty of obstacles standing between you and a thriving business. In this blog post, we will be looking at some tips on how to build success as a professional wedding photographer in today’s market.

Cost of running your photography business

For wedding photographers, launching a business presents an incredible opportunity for creative expression and financial reward. However, there are some expenses to take into account before beginning.

These include the major cost of equipment such as cameras, lenses, and lighting, then you also have to factor in everyday expenses like website hosting and marketing. Paying for travel and accommodation if working as a destination photographer is another significant cost.

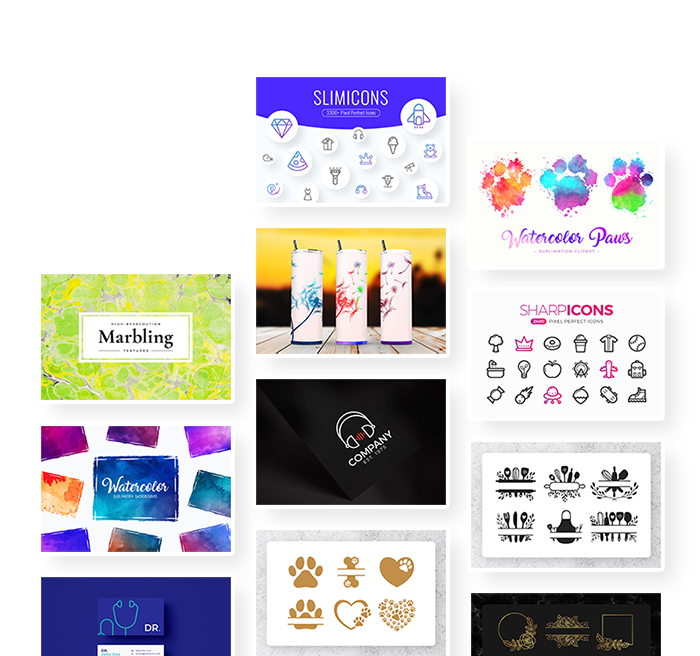

When a photographer is setting up their business, branding is an essential cost that can really add up. This includes purchasing a logo & business cards, or other branding materials.

Fortunately, in the digital age, there are plenty of inexpensive branding templates available online that can help a photographer create a cohesive branding package without breaking the bank. No matter what design you choose, branding provides the necessary elements to create a professional image for your business.

As a photographer, it is important to understand all the necessary expenses and taxes that will be paid throughout the year. Taxes must be accounted for in order to remain compliant with the rules set by the federal government while ensuring that you are getting appropriately compensated for your services. Don’t forget about keeping up with industry trends to stay competitive and taking classes or investing in software too. With enough planning and dedication, you can be sure your investment in photography equipment will pay off.

How to set your rates as a wedding photographer

As a wedding photographer, one of the most important business decisions you’ll have to make is setting your profit margin. Knowing how and where to spend your money can greatly increase both your profits and satisfaction with the overall end product. It’s important to consider both your costs and the earning potential when making this decision.

Researching similarly-sized wedding photography businesses in order to determine trends in pricing can help to give you a better idea of how to charge your clients.

If you have recently decided to become a wedding photographer, it is important to make sure you are setting your profit margin correctly. Establishing the right profit margin helps ensure that you can cover your costs as well as make a living.

You should also think of the value and quality that you are providing over other options in order to decide on what kind of price point you want to set. Ultimately, finding a consistent balance of profits and quality will provide couples with beautiful memories for years to come.

Hourly vs flat rates

When it comes to wedding photography, wedding photographer needs to decide whether they should charge their clients an hourly rate or a flat rate. It is important to weigh the pros and cons of either option when making this decision, as both have unique advantages and drawbacks that could affect the overall success of wedding photography services.

From an hourly rate, wedding photographers have the flexibility to use their discretion in setting different rates based on experience, location, type of service, and even time of year. On the other hand, a flat rate gives wedding photographers the same fee for each gig regardless of what time it takes them to complete the service.

Therefore, wedding photographers will need to consider all factors involved in order to make an informed decision about how best to charge for their wedding photography services.

Entry-Level vs experienced wedding photographers

When it comes to wedding photography, experienced wedding photographers are often the go-to for many couples. However, when you’re on a smaller budget and need quality wedding photos, you may want to consider entry-level wedding photographers.

While they charge less than experienced wedding photographers, they do put forth just as much effort in capturing beautiful photos of your special day. Entry-level wedding photographers also come with the added bonus of being able to work closely with you on creating your perfect wedding album.

Use social media to promote your photography business

For wedding photographers just starting out, getting their name out there can be a daunting task. While there are tons of advertising agencies that offer services to wedding photographers, such as running media campaigns or publishing ads, many wedding photographers are finding success in utilizing social media.

Platforms such as Instagram and Facebook present wedding photographers with the unique opportunity to promote their portfolios for free through likes, shares, and comments from peers and other industry-related accounts. These platforms are also great for organic growth by simply posting wedding collections from events you’ve shot.

Also, don’t shy away from connecting with potential couples directly. Many brides these days know what they want way before the wedding date is even set and love to have multiple sources of inspiration when choosing a photographer.

Conclusion

Starting a photography business is a very rewarding experience but it’s important to factor in all the costs that come with it before taking the plunge. Make sure you have enough saved up to cover the cost of high-quality equipment and everyday expenses.

Once you have all your finances sorted out, you can start dedicating yourself to becoming a successful wedding photographer.

With enough planning and dedication, your investment in photography will pay off in no time.

15,000+

Design Assets

- Instant Access

- Free Content Updates

- Constantly Growing Library

- Unlimited Downloads

- Simple Licensing

By Dreamstale

Get creative with our free & premium design resources. Download a vast collection of graphic design materials, such as graphics, sublimation designs, icons, textures, stock photos and more.

Plus get access to Photoshop tutorials & inspirational articles that will spark your imagination.